Does Costco Register Limit The Type Of Groceries You Can Buy With Ebt Card

Your Guide To Daily ATM Withdrawal Limits and Debit Purchase Limits

- Why They Exist

- Boilerplate ATM Withdrawal Limit

- Debit Card Purchase Limit

- Limits at Major Banks and Credit Unions

- How To Increase Limits

NgKhanhVuKhoa / Getty Images/iStockphoto

All banks and credit unions identify limits on the amount of money that a person can withdraw from their account at a time.

Why Do ATM Withdrawal Limits Exist?

Consumers with money deposited in a banking concern and credit spousal relationship face limits on ATM withdrawals and debit card purchases as a mode of protecting the financial institution and the consumer.

If a debit card and Pivot are stolen, daily ATM withdrawal and debit carte du jour purchase limits ensure that an account isn't wiped clean by fraudsters. Financial institutions also desire to ensure they have plenty greenbacks on hand to come across the demands of cash withdrawals for other customers on the same solar day.

Practiced To Know

If y'all have a large amount of money in a banking company account and want to brand a withdrawal, program ahead. Yous may need to give your financial institution accelerate notice so they can social club additional cash for your request. Alternately, you may have a cashier'south check or coin wire for the remainder in your account.

What Is Your ATM Withdrawal Limit?

ATM limits vary for each bank or credit union. Daily limits range from $300 to $v,000 per solar day depending on your account type and agreement with your financial institution.

Can I Withdraw $five,000 From an ATM?

In about cases, the answer is no. On average, an ATM is used for 300 transactions per calendar month, or around 10 times per day. Allowing withdrawals of $v,000 from an ATM would hateful refilling the motorcar more frequently and requiring a bank co-operative to take more cash on hand.

Alternatives to using an ATM to access $v,000 in a single transaction include:

- Going into a banking concern branch

- Using a debit menu to brand a purchase

- Transferring via an Automated Clearing Business firm to another business relationship

- Requesting to wire money for a payment

What Is Your Debit Card Purchase Limit?

Purchase limits on a debit card are usually higher and may be up to the unabridged residuum in your bank account at a given time. Debit card limits vary greatly based on rules set by the bank or credit union.

Advice

Consumers who need a temporary increment for a one-time big buy should telephone call their financial institution. Banks and credit unions often elevator limits for a short fourth dimension and on a example-by-case basis.

Factors that affect a person's withdrawal and purchase limits include:

- Type of account

- Length of time as a customer

- Average daily residuum

- History of overdrafting or exceeding your account limit

- Credit score and credit history

Daily ATM Withdrawal and Debit Card Purchase Limits at Major Banks and Credit Unions

Here's what you lot demand to know about the limits at various banks and credit unions effectually the country. Numbers in the chart are accurate every bit of Feb. 10, 2022.

| Depository financial institution or Credit Union | Daily ATM Withdrawal Limit | Daily Debit Carte Purchase Limit |

|---|---|---|

| Marry Bank | $1,000 | $five,000 |

| Bank of America | $ane,000 | $5,000 |

| Upper-case letter Ane Bank | $1,000 | $five,000 |

| Chase Bank | Depends on the business relationship blazon and a example-by-instance basis | Depends on the account type and a example-by-case basis |

| Citi Bank | $1,500 to $2,000, depending on the business relationship type | $5,000 to $10,000 depending on the account type |

| Navy Federal Credit Marriage | $1,000 | $3,000 to $v,000, depending on the account type |

| PNC Bank | $500 | $5,000 |

| Regions Bank | $808 | $five,000 |

| State Employees Credit Union | $ane,005 | $4,000 |

Pro Tip

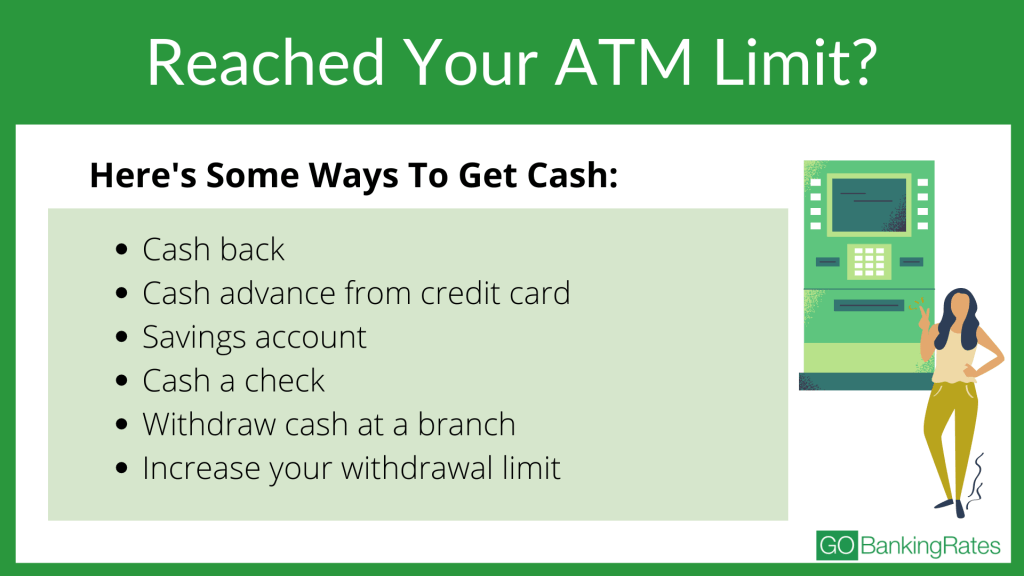

Consumers who accomplish the daily ATM withdrawal limits and notwithstanding need more cash can utilize a PIN-based buy at a retailer. Many retailers offering up to $100 greenbacks dorsum with a purchase.

Credit Card Cash Accelerate

Another way to access more than cash after reaching a withdrawal limit is to utilize the cash advance option on a credit card. Consumers should be wary of using this feature too often because of high involvement rates on cash back. Be prepared to pay back the cash accelerate quickly to avert overpaying in interest and fees.

Write a Bank check

Although consumers use checks less and less, information technology'due south still possible to employ one to access greenbacks in a bank account. Depending on the financial establishment, you lot may be able to cash a personal check this mode to access more than money in a pinch.

Withdraw Coin From A Savings Account

Consumers with extra money in savings may admission those funds via a transfer to the account owner'south chief checking business relationship. Alternately, you tin can transfer money directly from a savings business relationship to brand a payment via ACH. Go on in heed that Federal Regulation D limits the number of transactions on a savings business relationship each month to six, then this is non a long-term solution.

It's important to weigh the pros and cons of accessing extra cash past a daily limit. Tin can a buy wait until the next mean solar day? Is there another way to pay for a product or service other than cash?

How To Increment Your Withdrawal and Purchase Limits

Some banks and credit unions are willing to work with customers by increasing limits permanently. That depends greatly on policies, procedures and a consumer'southward relationship with the financial institution.

Tips for maintaining a proficient standing with a bank include maintaining a college average daily residual and not incurring an overdraft on the account. Don't let an account remainder become close to $0 regularly. Higher balances prove that a consumer knows how to manage coin and not exceed spending limits.

Even if accounts do get close to $0, consumers should at least ensure the balance doesn't become negative. Consistently surpassing the amount of money in an account is irresponsible. It indicates that the consumer cannot manage money properly.

Final Take

ATM withdrawal and debit card purchase limits are in identify for a reason. Consumers that consistently come across and exceed these limits may want to talk to their financial institution or rethink the mode they structure their spending.

Sean Dennison contributed to the reporting for this commodity.

Source: https://www.gobankingrates.com/banking/checking-account/atm-withdrawal-limits/

Posted by: munozsaided.blogspot.com

0 Response to "Does Costco Register Limit The Type Of Groceries You Can Buy With Ebt Card"

Post a Comment